China's Two Meetings: First Impressions

China focuses on the supply side, but the demand side is the biggest challenge

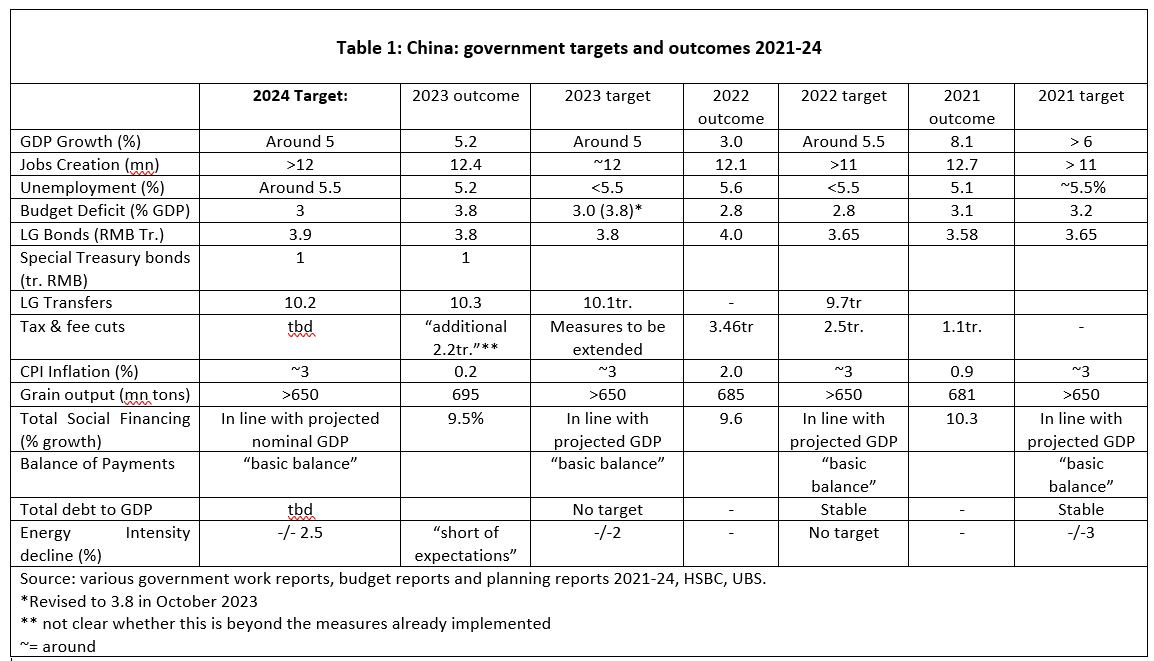

The highlight of China’s political year is usually the “Two Meetings” or Liang Hui, China’s Parliament, the National People’s Congress (NPC) and the China People’s Political Consultative Conference (CPPCC). This year was the first time that Li Qiang, China’s premier since last year March, did the honours to read out the government work report (GWR). In Parallel, the Planning Report and the Budget Report were submitted for review to the NPC. The GWR, duly approved by the communist party’s Politburo meeting of February 29, contained few surprises. It revealed the projected GDP growth target of “around 5 percent” and offered some modest macroeconomic policies to support this (Table 1). This support will be needed, as the consensus forecast of Focus Economics, a research firm, put the average expectation among banks and other analysts at 4.6 percent, the same as the IMF projection in January this year. Provincial governments, which have already published their forecast in the past couple of months, projected on average a growth rate of 5.4 percent, with few provinces below 5. This suggests that the “around 5 percent” had already been agreed at the Central Economic Work Conference of the Central Committee of the Communist Party of China (CPC) in December last year.

Early reactions on the target call it “ambitious” and this is likely to have been intentional. One of the key and intractable problems the government has been struggling with is the expectations of people and investors ever since the COVID-19 lockdowns and regulatory crackdown on internet platform companies and others. China’s leadership is aiming for a major reorientation of the economy towards what it dubs to be “high quality growth.” While few would disagree with such objective, a burning question is how much growth that would imply. After all, it is overall growth that determines investment opportunities and jobs, and insecurity concerning growth prospects is holding back demand. Choosing an ambitious indicative target signals that China is still seeking relatively high growth, despite the challenges the country faces.

Premier Li did not mince words on those challenges:

“The foundation for China’s sustained economic recovery and growth is not solid enough, as evidenced by a lack of effective demand, overcapacity in some industries, low public expectations, and many lingering risks and hidden dangers. Furthermore, there are blockages in domestic economic flows, and the global economy is affected by disruptions. Some small and medium-sized enterprises (SMEs)face difficulties in their operations. We are confronted with both pressure on overall job creation and structural employment problems, and there are still many weak links in public services. Some primary-level governments are facing fiscal difficulties.”

The lack of domestic demand coupled with growing capacity for manufacturing is becoming a key issue for China. For one, it has started to affect prices, and some see the spectre of deflation looming for China. The consumer price index was barely in positive territory last year, at 0.2 percent increase, but the GDP deflator, reflecting prices for all outputs, declined by 0.6 percent last year, and even 1.6 percent in the last quarter. Combine this with falling asset prices—notably real estate and the stock market—and the risks of a deflationary spiral become real. In this context, the government’s indicative target for consumer price inflation at 3 percent for the year seems optimistic

A second problem with lacklustre domestic demand is that China’s external surpluses, in particularly in manufacturing, are growing rapidly, and are causing renewed tensions. The EU has announced an investigation into China’s electric vehicle (EV) exports, which it argues is boosted by inappropriate subsidies and overcapacity in China’s car industry. The US, which already has a 25 percent tariff on Chinese vehicles, and President Biden has recently tagged China’s EVs as a security risk. Presidential hopeful Trump has already announced he would slap a 60 percent tariff on all Chinese exports to the US. While these policies of the EU and the US may be flawed, it does provide additional reason to seek higher domestic demand.

Domestic Demand

In the medium term, households should play a larger role in demand, which can be done by reforms in the labour market, in social security, the tax system and the household registration system. But these reforms, even if desired by Chinese leadership, will take time. In the short term, government stimulus is key. China has been reluctant to pursue a stimulus in recent years, even amid the challenges of COVID and the real estate slump. In part this seem sot be motivated by the notion that the money would reignite the real estate bubble and be wasted on real estate development or infrastructure that no one will use. But this need not be the case—in fact, there are plenty of needs the government can address, and which would stimulate demand.

Prime among them is the country’s green transition, which requires massive investment in new energy (as also pointed out by Martin Wolf’s piece in the Financial Times). China is pretty much on track for its 2060 goals, but the government could well decide to accelerate the transition and frontload the needed investments. According to estimates by Tsinghua University, the net zero goal could cost about 100% of 2020’s GDP. So plenty of “good” investments there. A second promising area is subsidies for households to buy more of the outputs of China’s surging EV manufacturing. This would equally help the energy transition and reduce protectionist pressures from abroad. These and other measures would meet Li Qiang’s call in the government work report: “We should appropriately enhance the intensity of our proactive fiscal policy and improve its quality and effectiveness.”

Fiscal Policy to the rescue?

Any meaningful economic stimulus would have to come from the fiscal side. On the financial side, with debt levels well over 300 percent of GDP, monetary policy will continue to be “prudent” and total social financing is projected to grow in line with GDP. This does not provide much stimulus, even though enterprise appetite for borrowing seems to be gradually returning.

With a headline budget deficit of 3 percent of GDP, the same as last year’s budget, it will be the special items in the budget that should provide this stimulus. Among those is an (off-budget) special bonds issue of RMB 1trillion (about 0.7 percent of GDP), carry-overs from unspent money from last year, and withdrawals from the stabilization fund. UBS, and investment bank, estimates that the overall projected deficit on a cash basis will be 8.2 percent of GDP, compared to 7 percent in 2023.

Much of the fiscal punch will depend on the uptake by local governments of the 3.9 trillion (2.8 percent of GDP) in bonds that they are allowed to issue. It is not all that clear that all of them would want to use their quota: their revenues have been decimated by the rut in real estate, which has sharply cut revenues from land lease sales. Moreover, financing through the “backdoor” by means of local government financing vehicles (LGFV) is likely to be much more limited, as the sector is consolidating its debts. And debt, including LGFV debt is high-now estimated to be over 80 percent of GDP.

The government has pledged more support for the real estate sector, and has dropped the ominous “housing is for living in, not for speculation,” but it is reluctant to bail out real estate developers on a large scale. Social housing and policy support loans may give some relief for property developers, and for demand, but at best stabilization at a much lower level of activity compared to that before COVID.

Alleviating some of the debt burdening local governments could also help restore the levers of macro-economic policies. The government had already announced last year support for resolving some of the local government debt problems, and some of the proceeds of local bonds issue can be used for that. Unexplored thus far is using state asset sales to pay down some of the debt. Some of the most highly indebted provinces have lots of valuable state assets. For instance, in Guizhou, total government debt at the end of 2022 was RMB 1.2 trillion. At the same time, the government also owns 60 percent of Moutai, a liquor company, currently valued at RMB 2.1 Trillion. While it is a highly enjoyable drink, baijiu is hardly a strategic industry—or to use the new term, a new productive force.

New Productive Forces

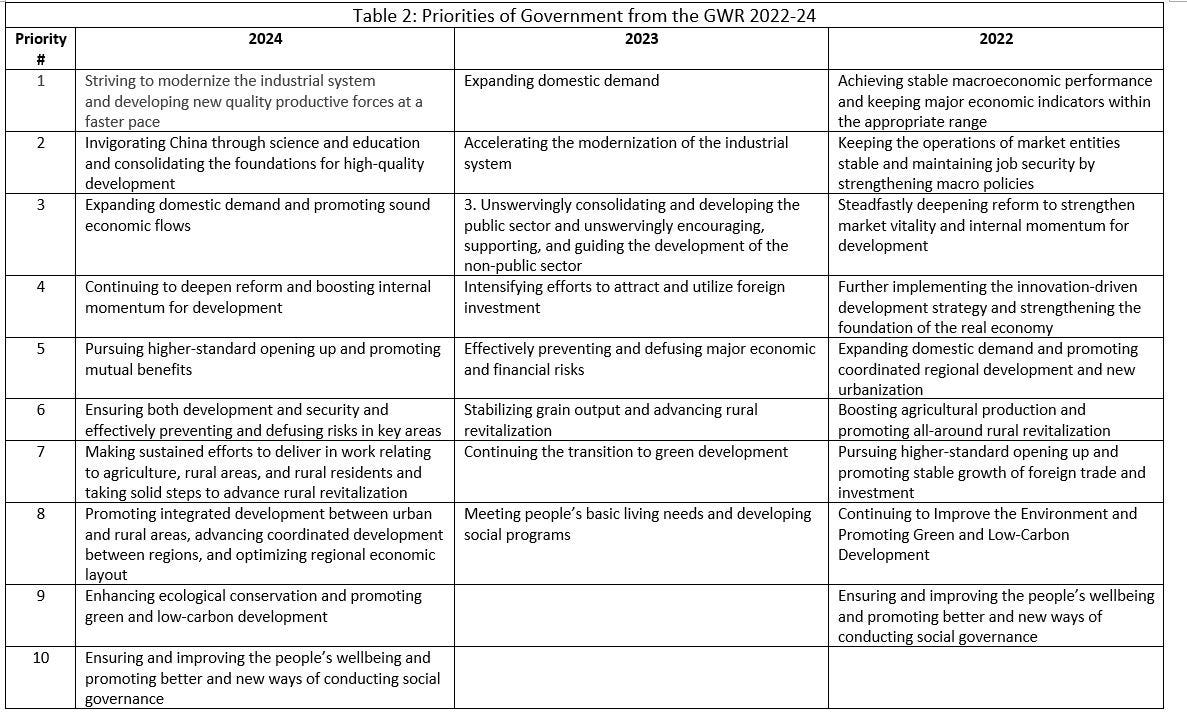

The government work report focused on “new productive forces,” a new concept recently introduced by President Xi Jinping last year. This is part of the broader project of High Quality Growth (an oft-repeated term in the government work report), and can broadly be interpreted as more innovative, productivity driven growth. This year’s government work report puts it as the number 1 priority (Table 1), up from last year and ahead of domestic demand (number 3). To support China’s structural economic transition to new growth areas, the report stresses developing modern industries and improving productivity. New emerging sectors including those in which China already leads (e.g. EV, solar, wind, high speed rail) and those with cutting-edge technologies (such as hydrogen, new materials, innovative drugs, among others). In addition, the government vowed to industrial digitization and AI, increase R&D and innovation, improve the use of public data, and bring forward some construction of digital infrastructure.

The government seems well on the way on achieving the transformation: spending on Research and Development is now 2.6 percent of GDP, outpacing the level of the EU; and bank loans that used to go to real estate, are now flowing into manufacturing. Industrial policy has also been transformed: the new party Central Commission for Science and Technology is now directing and coordinating the efforts, and it not only promotes the modern industrial system, but now also the “future industries,” i.e. those still in the research stage, but which one day may be the leading industries in the world, such as advanced AI, humanoid robots, brain-computer interface, quantum computing, etc. During the Two Sessions, the stocks of some of the enterprises engaged in these future industries (such as Ubtech Robotics and HK Beijing fourth Paradigm Technology) doubled in value on the Hong Kong stock market.

Though mentioned by the premier, the issue of overcapacity received scant attention in the government work report. In general, China is more focused on the new rather than resolving issues in the older industry. Some of these issues are triggered by industrial policy itself: once declared a priority sector, every local government wants to be in it. The problem is that even loss-makers continue to hang around for a long time. This is a problem for China, as its productivity growth is held back by the laggards, but also for other countries, which face competition from industries that sell on the world market at prices that show little regard for the bottom line. This is the main complaint of the EU with regards to Electric Vehicles today, and addressing the issue is therefore key in averting the risk of more trade tensions.

No Premier Press Conference.

Perhaps the biggest news coming out of the NPC meetings thus far is that premier Li Qiang will not hold a press conference at the end of it. This breaks a 30 year tradition, and passes on an opportunity to explain the government’s policy directions. Past press conferences, even though tightly managed, were a rare opportunity in which Chinese and overseas press could interact with the second most senior policy maker. Dropping the presser may have something to do with premier Li Qiang’s personal preferences, but more likely it is a further sign that the CPC is the sole policy authority in the country, and that the State Council is fully aligned with the party.

The new direction was already quite clear from last year’s press conference, Li Qiang’s first (and now last), in which he expressed his job to be to implement whatever the CPC Central Committee has decided. At a February 19 meeting he reiterated that the State Council must “follow the instructions” of the Central Economic Work Conference (CEWC). The Central Economic Work Conference last December called for "加强经济宣传和舆论引导,唱响中国经济光明论" (Strengthen economic propaganda and public opinion guidance, and promote a positive narrative about the bright prospects for the Chinese economy). The premier's presser did just this, and it is a pity it is gone.

Centrally planned economies have much better control of production than they do consumption unless they promote shortages and accept that some will have to do with out. And generally, bureaucrats make poor businessmen, just as businessmen make poor bureaucrats.